PPF Calculator - Calculate Public Provident Fund Maturity Online

The PPF Calculator is the perfect tool for anyone who wants to calculate returns, plan savings, and make the most out of their Public Provident Fund account.

Investment Details

Investment Summary

Maturity Results

Yearly Growth Visualization

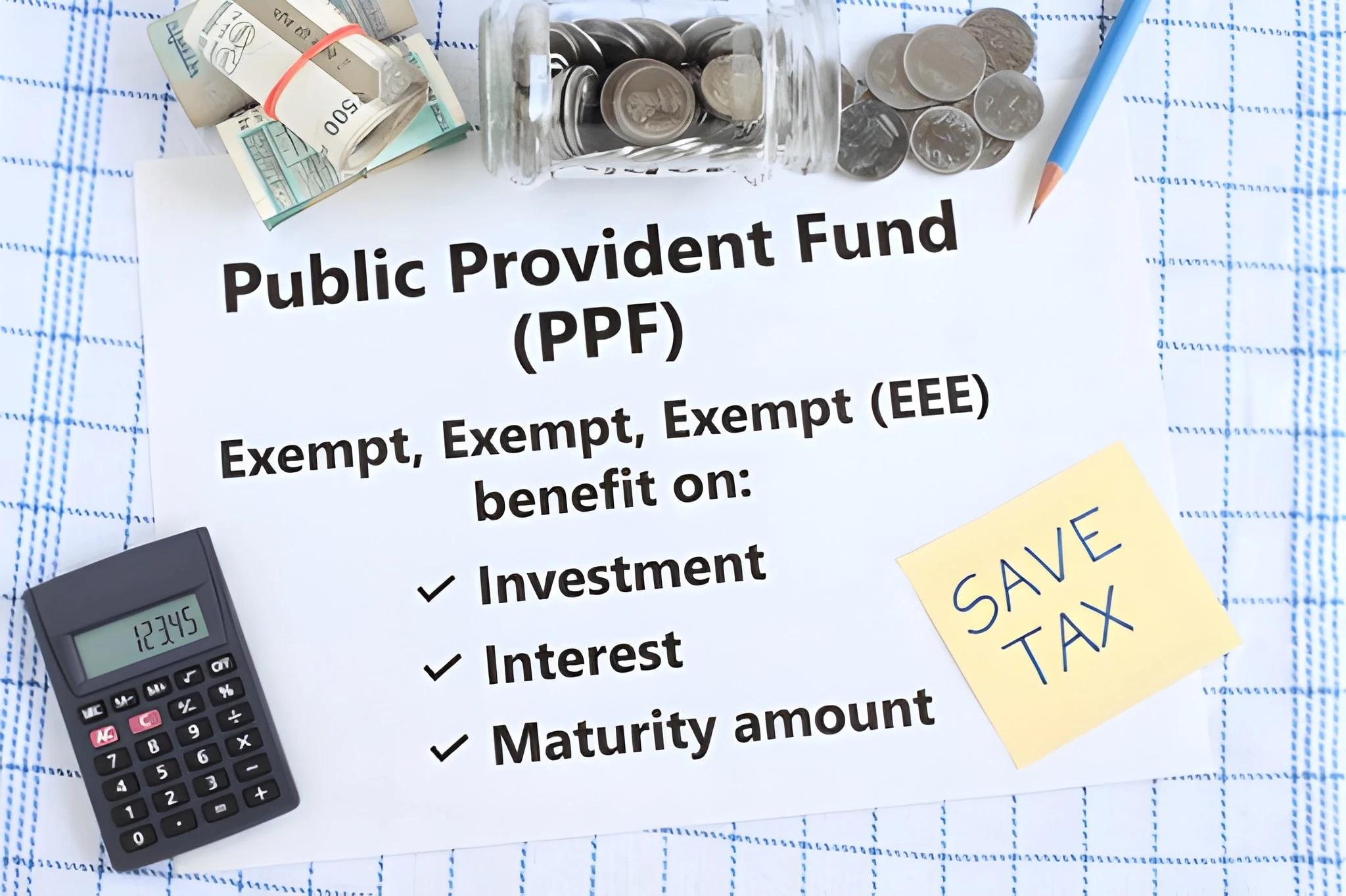

PPF Benefits

- ✓Tax-free returns under Section 10(11) of the Income Tax Act

- ✓Tax deduction up to ₹1.5 lakh per year under Section 80C

- ✓Long-term savings with 15-year lock-in period

- ✓Backed by the Government of India (Risk-free investment)

Related & Other Popular Calculators, Tools

A PPF Calculator is a useful and practical tool which calculates the maturity amount you may have from your Public Provident Fund investment. PPF is a very safe long term investment option offered in India with decent interest rates, guaranteed returns and tax benefit under Section 80C.

The PPF Calculator let you easily estimate your wealth creation over a selected period of time by entering your investment amount, tenure, and rate of interest.

What is a PPF Calculator?

A PPF Calculator calculates the maturity value of your PPF investment taking into consideration three components:

With our PPF Calculator, you can plan your savings effectively, receive maximum returns, and get an idea of how your funds will grow over an extended period of time, all without calculating manually.

How the PPF Calculator Works

The PPF calculator works on the basis of the Compound Interest formula to calculate your return. The maturity amount consists of both your investment amount, and the interest earned throughout the time of the investment.

Here is an example:

It is clear how a consistent investment in PPF can build long term wealth.

How to Use the Online PPF Calculator?

Why Use Our PPF Calculator?

The PPF Calculator provides not only accurate maturity results but also a yearly growth visualization chart that clearly maps out how your money grows year to year. Whether planning for retirement, your child's education, or simply wealth creation, the PPF Calculator is a great asset to have.

FAQs

You can invest upto ₹1,50,000 in PPF in a year.

Yes, the maturity amount received from PPF is completely tax-free under Section 80C and Section 10 of Income Tax Act.

Yes, after maturity you can extend your PPF account in blocks of 5 years with or without contributions.

The interest rate for PPF is fixed by the Government of India quarterly, and may change it based on different factors.

The PPF calculator helps to estimate the maturity value, compare various scenarios and better meet your long term financial goals.

You can partially withdraw after 7 years, but you cannot get the full maturity amount until after 15 years.